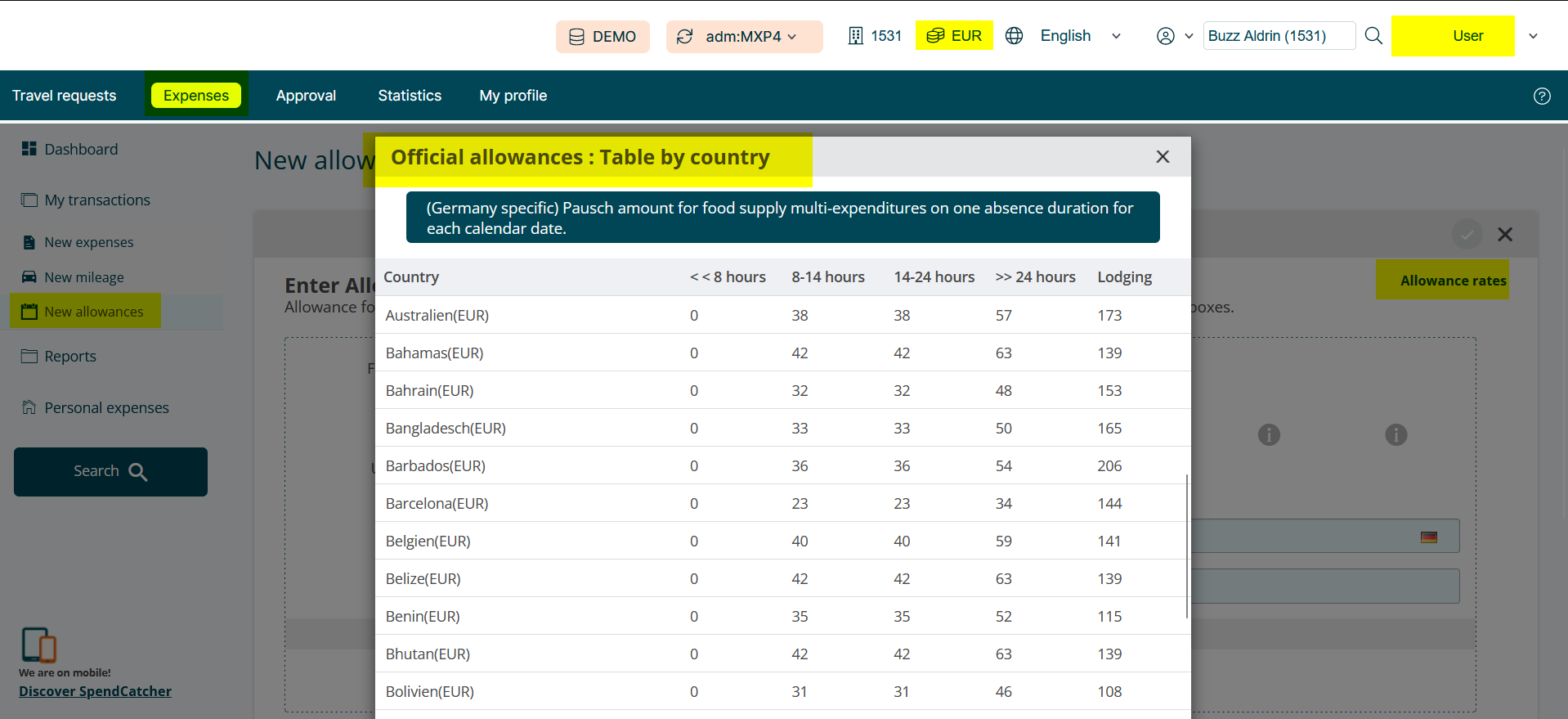

🪙 In the context of travel expense management, an allowance rate is a predefined amount of money that employees can claim per day or per specific activity to cover their expenses while traveling for business purposes. It typically includes costs for meals, lodging, and incidental expenses, and is designed to simplify the reimbursement process by eliminating the need for detailed receipts.

🔑 Key Points:

-

Predefined Amount 💸 : A set daily or activity-based rate for covering travel expenses.

-

Expense Categories 🏷️ : Covers costs such as meals, lodging, and incidentals.

-

Simplified Reimbursement 💰: Eliminates the need for detailed receipts, streamlining the reimbursement process.

-

Policy Compliance 👌: Ensures that expenses stay within company policy limits.

-

Consistency 🤝: Provides uniform rates for all employees, simplifying budgeting and financial planning.

Example:

An employee on a business trip is given an allowance rate of $50 per day for meals and $100 per day for lodging, regardless of the actual costs incurred, provided they adhere to the company's travel policy.

Benefits:

-

Ease of Use: Simplifies expense reporting and reduces administrative burden.

-

Predictability: Helps with budgeting and cost control by providing fixed rates.

-

Compliance: Ensures adherence to company travel policies.

-

Efficiency: Speeds up the reimbursement process by avoiding detailed expense documentation.

If you want to learn more about legal allowance rates specific to your country and many other compliance topics, please refer to the links below: